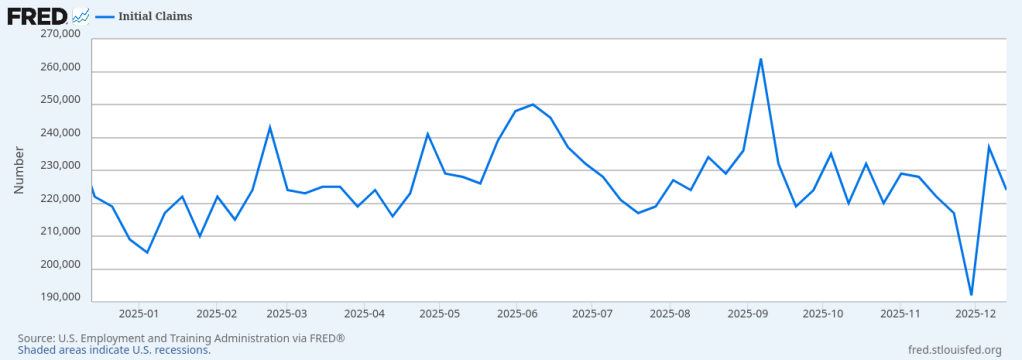

The number of first time jobless claims (a weekly statistic measuring the number of folks filing their first claim for unemployment insurance when they become unemployed) has been bouncing around 250,000 for the last year and change.

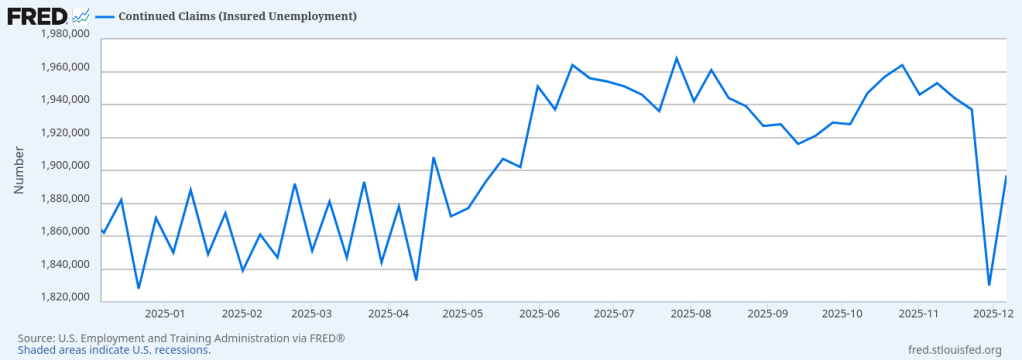

A related number, the continuing claims, which measures the number of unemployment claimants who are continuing to file for benefits has also been remarkably steady.

While it looks like there was a big jump in May, it was a change from 1,800,00 to about 1,940,000, of about 7-8%. And then it stayed steady. Meanwhile, unemployment has been slowly creeping back up over the last two years.

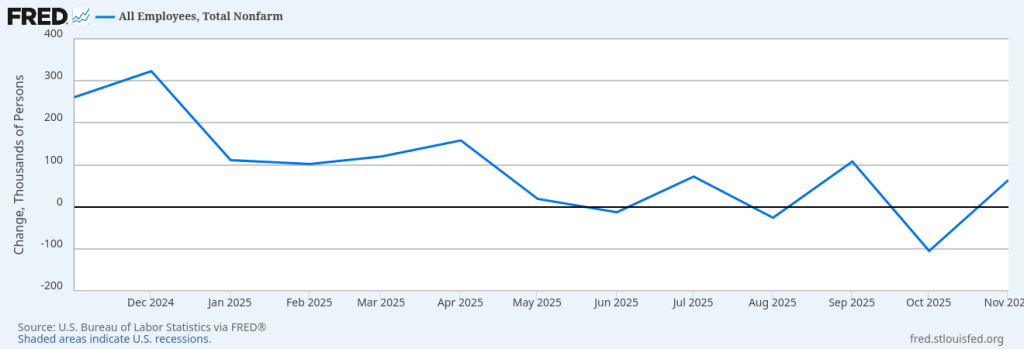

Meanwhile, we see a definite softening of new jobs created. The change in non-farm employment shows a degree of cooling in the economy.

What would we expect to see, if job creation is slowing, along with an up-tick in the unemployment rate? We’d expect to see more claimants for unemployment insurance. Fewer jobs, more layoffs, and lots of stories about graduates that can’t find jobs (who cannot apply for unemployment insurance), indicate a soft labor market. We see the average weeks of unemployment (how hard it is to find a job once you lose your job), tick up slightly but not decisively, by about 2 weeks, but still within statistical noise.

With today’s CPI coming in a lot softer than expected, this will give the Fed a green light to cut. But as much as we see evidence of a slowing job market, we don’t see more and more people applying for unemployment, what gives? Is this just what a more normal employment market looks like after the go-go job markets of 2021 to 2023? When there were many times more jobs open than there were candidates?

First, we have to remember a few things that may be complicating the first time claims picture. First is that the new graduate cannot claim unemployment. If a new high-school or college graduate cannot find a job, they cannot claim benefits because they haven’t worked for an employer that paid into the insurance pool. If you quit because your commute would be 2 hours (after you moved because even your boss was saying WFH would be the new normal), you are not eligible. If your employer claims it was for cause, you are not eligible. That’s why many employers will try to cite ’cause’ as the termination reason, even though they’re firing dozens or hundreds of people at the same time. Nor are independent contractors. if you were an independent IT contractor at US AID and your contract was terminated, you are not eligible. You basically have to work on a “W-2” basis for an employer that terminates you for non-performance (or criminal) reasons.

Then there are other reasons, such as deciding not to claim benefits, because you can make more money driving for Uber. (Or at least you think you can make more money driving for Uber). If you make more money than your benefit check at a part time job, you can’t claim benefits. Some people won’t claim it out of principle. And some people live in states that felt too many workers were getting cushy at home instead of returning to the workforce and made it harder to claim benefits.

Does an increase in first time claims (or continuing claims) predict a recession? No. It is a trailing indicator. Generally corporate profits fall, along with Wall Street’s expectations of future profits, as the economy slows. At that point corporations realize revenue won’t grow, so they have to cut costs to keep their margins. One quick way is to lay off staff. Often, this is a time for the company to prune their deadwood projects. These are projects they’re putting money into because it seemed like a good idea at the time, but no one seems to be able to kill it now that it’s shown to be a dud. Managers are human, too, and subject to biases like the ‘sunk cost’ fallacy. This is the push that management needed. But sometimes they just reduce head-count to the point of pain, because they can coast on their accumulating inventory until business improves. Only after output falls (a recession begins) does employment really contract.

But it is still striking there’s been so little movement in first time claims. It feels like you could place bets on it being between 220,000 and 240,000 next week and the week after. Do I think it’s being manipulated? No. While it was popular among the right to say Biden’s numbers were all fake and made up, I never thought that claim was based in reality and I don’t think there’s any skulduggery now. Did Trump send a worrying signal by firing statisticians? Yes, but I believe the core of the process is still very much intact. Are the numbers massaged? Yes, sometimes seasonality needs to be taken into account, otherwise the increase or decrease would be overstated and the period to period changes are harder to compare. And if you think that’s an issue, most numbers are also released without seasonal adjustment. So, go look for yourself. Are numbers revised? Yes – because sometimes data doesn’t come in on time. This is especially true of the employment survey, with some employers submitting data weeks after the data was due.

What we may be seeing is a change, or a beginning of a change, in the relevance of this number. Due to a variety of factors, it’s becoming less sensitive to changes in the health of the labor market. If you lose your job, your ability to access smaller benefits may be reduced. And employers may be getting better at incentivizing you to quit and unable to access your benefits. For example, we need you to report to work 3 states away and we won’t help you move. The first time claims may be very slow to move, if at all. Like we are seeing unemployment hit 4.6% but little to no change in the first time claims.